Why are mobile payments on the rise and how are they changing the world of eCommerce?

With the largest population of millennials and Gen Z in the world, India is leading the charge when it comes to using digital payments for online and offline purchases.

In 2022, India clocked 70 billion digital payment transactions, the highest in the world. Statista reports that this figure is a sharp increase from 44 billion in 2021. On average, India is witnessing 280 million digital transactions every day.

In today’s tech-savvy world, mobile payments are taking the financial market by storm. From purchasing items online to paying for goods at a physical store, this innovative payment method is being welcomed with open arms.

The surge in mobile users, coupled with the affordability of internet services, has paved the way for mobile payments to become a game-changer in the business world.

Thanks to mobile devices, consumers can now conduct transactions at their convenience, anytime and anywhere, without the need to carry cash or credit cards.

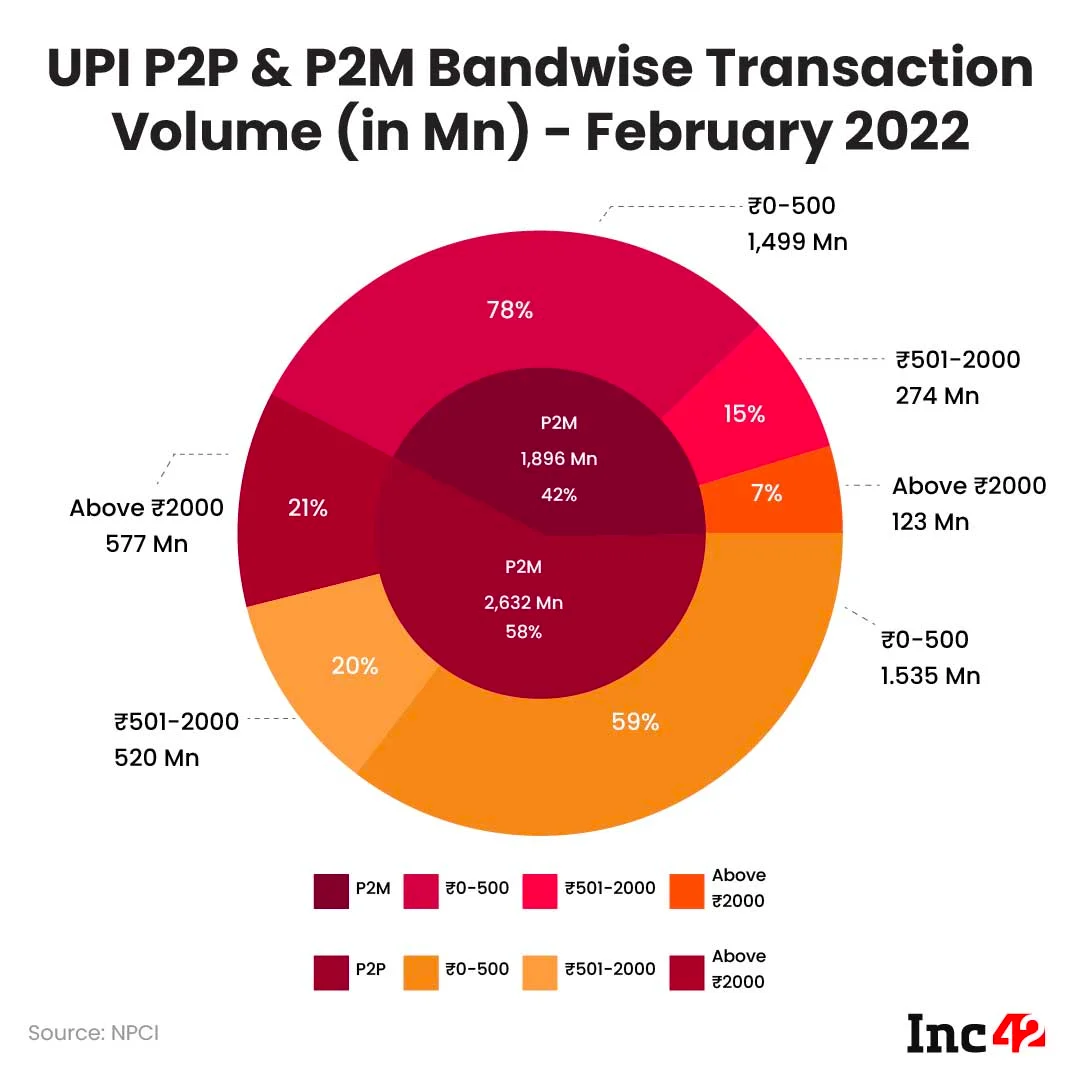

The image above does the job of showcasing the growth of India’s digital payments market. Part of this growth is because of COVID-19, but also due to amazing new technologies that have been developed and introduced by fintech organizations.

With the largest population of millennials and Gen Z in the world, India is leading the charge when it comes to using digital payments for online and offline purchases. In 2022, India clocked 70 billion digital payment transactions, the highest in the world.

Statista reports that this figure is a sharp increase from 44 billion in 2021. On average, India is witnessing 280 million digital transactions every day.

According to a recent report by Statista, the global mobile payment transaction volume is predicted to reach a whopping 4.9 trillion US dollars by 2024. A significant increase from 1.5 trillion US dollars in 2020.

The popularity of mobile payments around the world can be explained by a few factors.

Convenience

First and foremost, convenience! Mobile payments are a godsend for people who lead busy lives. With just a few clicks, they can pay bills, transfer funds, and make purchases online from the comfort of their own homes.

Gone are the days of carrying bulky wallets or purses, mobile payments make financial management a breeze.

Security

Another reason for the widespread adoption of mobile payments is the security factor. Traditional payment methods like cash or checks have long been vulnerable to theft and fraud.

In contrast, digital payments offer a high level of encryption and safety, reducing the risk of identity theft and fraud. Many mobile payment systems use biometric authentication for additional security, making them an excellent option for those who prioritize safety.

Speed

Speed is also a significant factor driving the popularity of mobile payments. Transactions made through digital payment methods are processed in real-time, ensuring instant transfers and purchases.

In today’s fast-paced world, people want immediate results, and digital payments deliver.

Globalization

Mobile payments have also become popular due to globalization. In today’s global economy, businesses need to be able to accept payments from customers worldwide.

With digital payment methods like PayPal and Stripe, companies can accept payments in multiple currencies and from customers in various countries, making international trade a breeze.

Lower Cost

Last but not least, lower costs are another reason why digital payments are increasingly popular. Digital payments methods often come with lower transaction fees than traditional payment methods like wire transfers.

Plus, they eliminate the need for paper checks, saving businesses on administrative costs.

So, there you have it. The rise of mobile payments is changing the financial game, offering people a convenient, secure, and affordable way to manage their finances.

What do mobile payments offer to eCommerce businesses?

Reduction in cart abandonment rates and increase in overall sales

Mobile payments are making it easier for customers to complete their purchases. In the past, mobile eCommerce had a higher cart abandonment rate because the checkout process was too clunky.

But now, mobile payments offer a more seamless experience, which means customers are more likely to stick around and make that purchase.

Providing businesses with valuable data insights

Not only that, but businesses can also gain valuable insights by tracking customer payment behaviour. It helps them better understand their customers and tailor their marketing efforts to them.

By analyzing customer spending patterns, businesses can even identify opportunities for upselling and cross-selling.

Offering a wider range of payment options

And speaking of payments, mobile payments offer a wide range of options for customers, from credit and debit cards to e-wallets and mobile payment apps like Apple Pay, Google Pay, and Paytm.

By giving customers more payment choices, businesses can make the payment process as convenient as possible.

Reaching new customers

Perhaps one of the biggest advantages of mobile payments is that it allows businesses to reach new customers, especially those who prefer to shop on their mobile devices.

And in developing countries where traditional banking services might not be as accessible, mobile payments offer a more affordable and convenient option.

The bottom line is…

It’s clear that mobile payments are here to stay and will continue to play a significant role in the eCommerce landscape. With the growing popularity of mobile devices, we can expect to see even more usage of mobile payments.

And who knows? With the rise of blockchain technology and cryptocurrencies, we might even see more secure and decentralized payment options in the future.

As a retailer, collecting and transferring payments from customers can be a hassle, that’s why we’ve introduced numerous payment methods in eCommfy to make life easier for our retailer customers.

We’re talking about payment gateways like Paypal, Authorized.Net, PayU, Paytm, Shiprocket, and UPI – all designed to cater to all sorts of online payment needs. And guess what? We’re not just about payment gateways!

We can also help you migrate your eCommerce website to a top-notch eCommerce platform. Our team of experts will work with you to create specific solutions tailored to your business needs. Get in touch with us today, and let’s make your eCommerce journey smooth sailing!

Branded Solutions

Branded Solutions